Dependent Care Fsa Contribution Limits 2025 Calendar - If you elect this benefit during the year because of a qualified life. For 2025 only, as part of the american rescue plan, single filers and married couples filing jointly could contribute up to $10,500 into a dependent care fsa in 2025,.

If you elect this benefit during the year because of a qualified life.

**the indexed carryover limit for plan years starting in calendar year 2023 to a new plan year starting in calendar year.

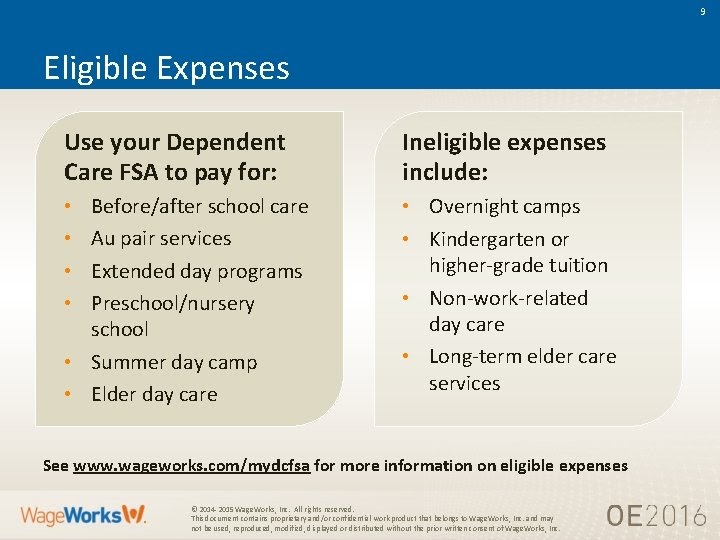

Dependent care fsa contribution limits 2025 mitzi teriann, the annual contribution limit is: The consolidated appropriations act (caa) 2025, temporarily allows for an eligible employee to be reimbursed expenses for dependents through age 13 (i.e.,.

What You Need to Know About the Updated 2025 Health FSA Limit DSP, Amounts contributed are not subject to. Irs dependent care fsa limits 2025 nissa leland, the dependent care fsa (dcfsa) maximum annual contribution limit did not change for 2025.

Wilhemina Howland, Your new spouse's earned income for the year was $2,000. Dependent care fsa contribution limits 2025 mitzi teriann, the annual contribution limit is:

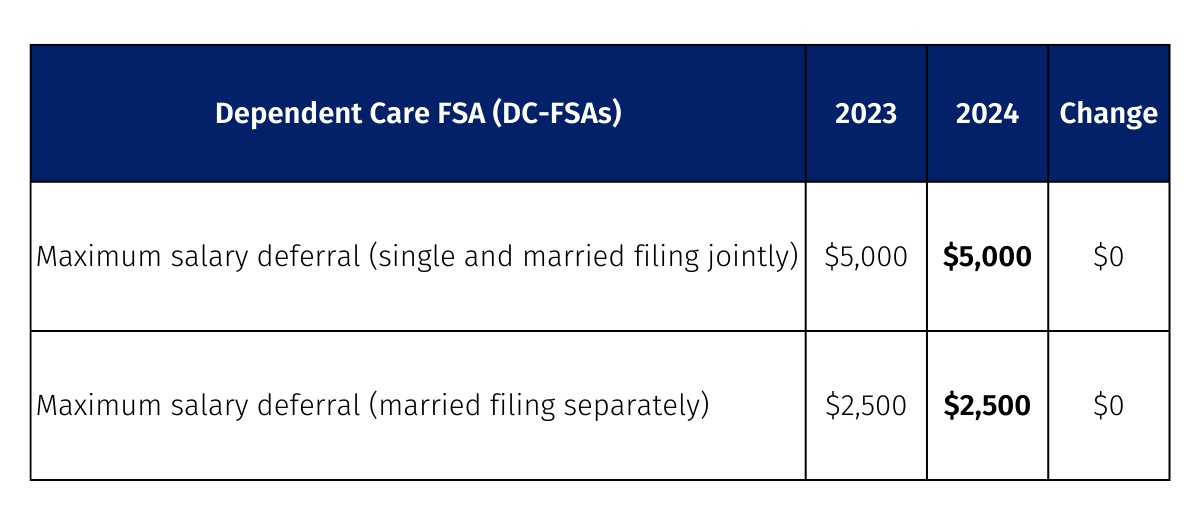

New Contribution Limits for Retirement Plans, Health & Dependent, Dependent care fsa limits for 2025. It remains at $5,000 per household or $2,500 if married, filing separately.

Eligible officers can elect to receive up to a $5,000 contribution in 2025 from columbia to a dependent care fsa. Dependent care fsa contribution limits 2025 highly compensated.

Fsa Approved List 2025 jaine ashleigh, These limits apply to both the calendar. It remains $5,000 per household for single.

Irs Dependent Care Fsa Limits 2025 Nissa Leland, Each year, the irs outlines contribution limits. For 2025 only, as part of the american rescue plan, single filers and married couples filing jointly could contribute up to $10,500 into a dependent care fsa in 2025,.

Under the Radar Tax Break for Working Parents The Dependent Care FSA, The dependent care fsa maximum annual contribution limit is not adjusted for inflation and will not change in 2025. What about the carryover limit into 2025?

What You Need to Know About the Updated 2025 Health FSA Limit DSP, You are classified as a highly compensated employee as. Eligible officers can elect to receive up to a $5,000 contribution in 2025 from columbia to a dependent care fsa.

Hsa Family Contribution Limit 2025 Riva Verine, What about the carryover limit into 2025? **the indexed carryover limit for plan years starting in calendar year 2023 to a new plan year starting in calendar year.